Labor Shortage Affecting Homebuilders

According to the National Association of Homebuilders (NAHB) latest survey, single-family builders and remodelers are facing a severe labor shortage, unmatched in the history of the yearly survey. This simple fact is heavily responsible for skyrocketing home prices across much of the country. (Other factors include lot shortages and rising materials costs.)

The survey spotlights that 55% of single-family builders reported labor shortages across 16 home building trades. While the greatest shortfall is a dearth of carpenters, the lack of skilled tradesmen in many other specialties is exacerbating the problem. As bad as this sounds, according to the builders, the survey reports that subcontractor shortages are even more severe than shortages of labor directly employed by the general contractors.

Exactly how bad is it?

Over 90% of builders reported shortages of subcontractors in all the categories of carpenters. Additionally, shortages were reported in many other trades crucial to homebuilding.

Framing crews were reported in short supply by 90% of builders. Bricklayers, concrete workers, and plumbers were reported by about 85% of builders. Concrete workers, electricians, and drywall installation workers were reported in short supply by about 82% of builders. The survey revealed that about 80% of builders revealed a shortage of painters and flooring installers. And about 70% of builders reported a shortage of roofers and excavators.

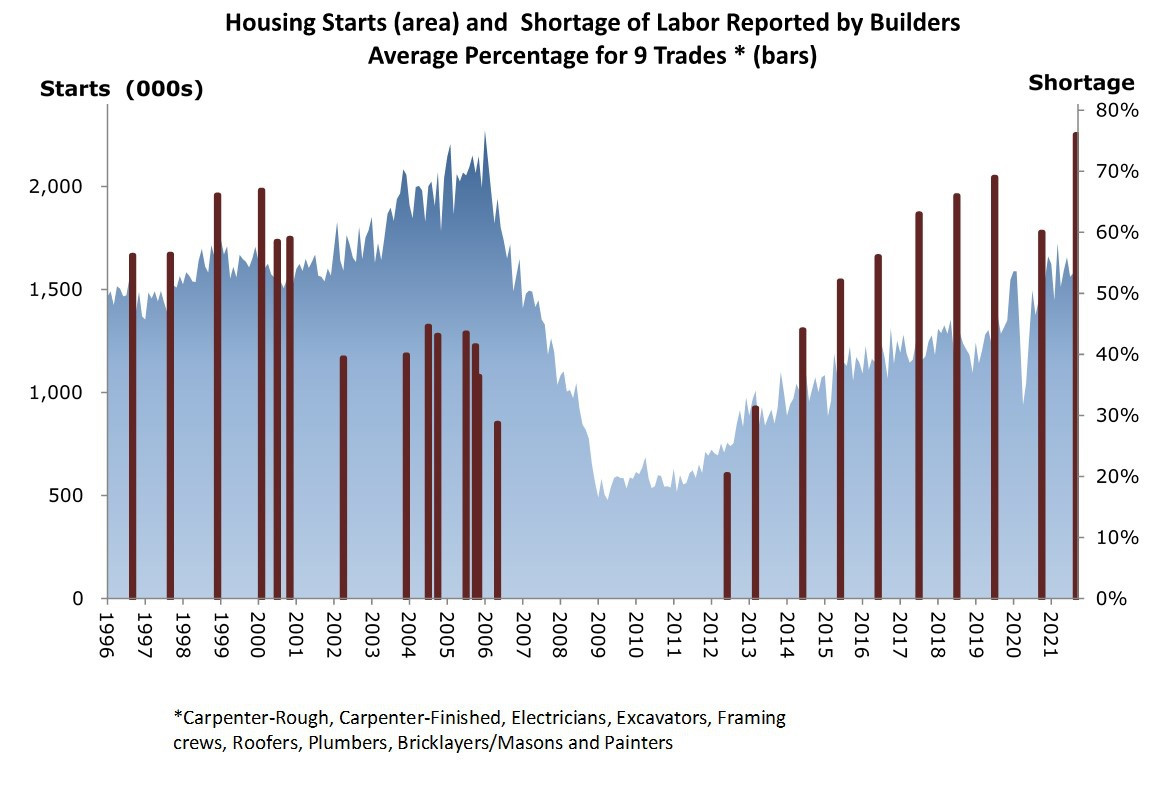

Among builders, shortages across these trades, is the worst ever reported, surpassing the previous record of tradesman shortages in the late nineties, which averaged 67% across the trades listed above. The average of shortages in the latest (2021) survey has reached an unprecedented 76%. During the housing boom of the mid-2000s, just 45% of builders reported shortages among these trades.

Other metrics underpin the shortage issue. According to the Bureau of Labor Statistics, unfilled construction jobs across the U.S. stood at 333,000. Another indicator is the layoff rate hit a four year low in the construction trades (1.6%) – obviously, builders are very reluctant to layoff a skilled tradesman for fear of not finding a qualified replacement.

In the months ahead, other issues are likely to further threaten housing affordability. Among the most prominent of these are supply-chain disruptions and higher interest/mortgage rates.

The survey also reported that only 56.6% of new and existing homes sold in Q3 were affordable to families earning the U.S. median income of $79,900. This stat represents the lowest affordability rate since the survey began in the mid-nineties.

As the adage goes, “A picture is worth a thousand words (ahem, in this case a graph).

Please see the chart below to get a visual of the challenges faced by the building industry and by prospective homebuyers:

Attracting skilled labor will remain a key objective for construction firms in the coming quarters and will become more challenging as the labor market strengthens and the unemployment rate declines.